Europe's Housing Crisis

Created by Yutong Zhao and Aidana Oryngaliyeva

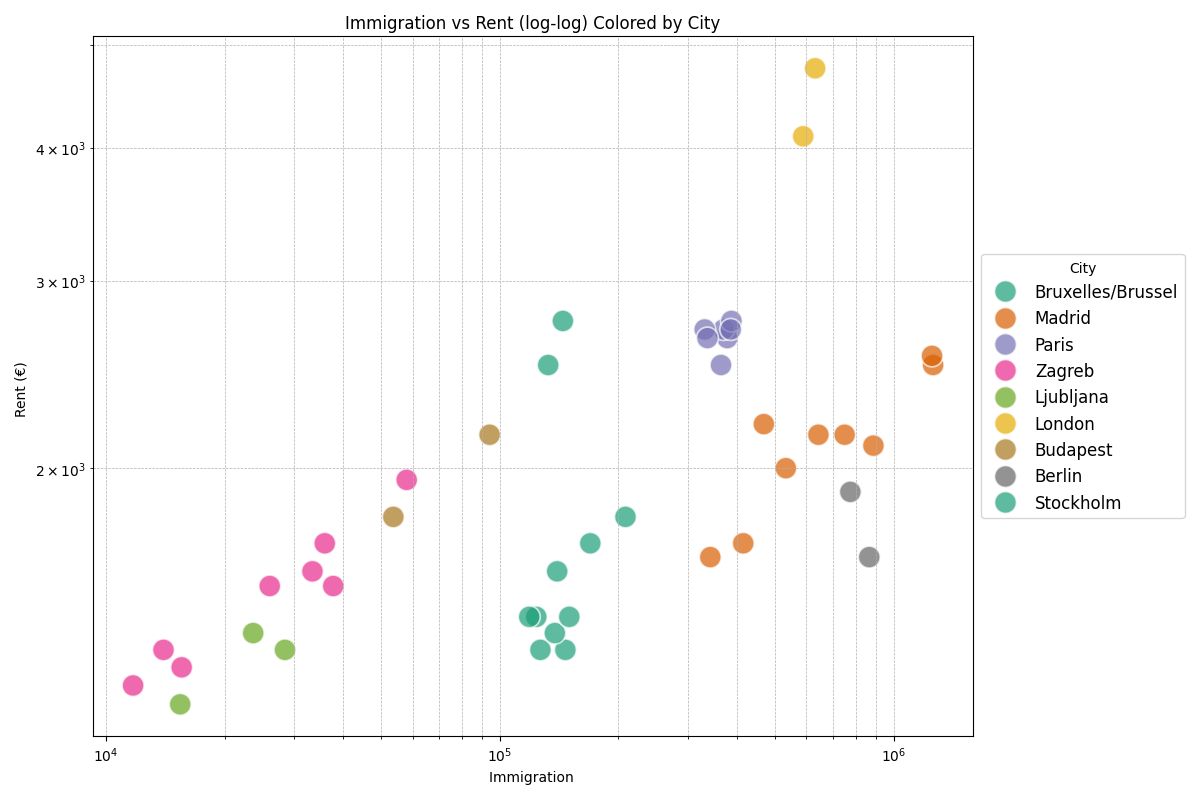

Across Europe, a housing emergency is unfolding. Young professionals can't afford city centers. Families are pushed to the periphery. Entire neighborhoods are transforming beyond recognition.

But what's really driving this crisis? Through six key data visualizations, we'll take you on a journey from macro trends to micro impacts, revealing the complex factors reshaping European cities—and what it means for millions of residents.